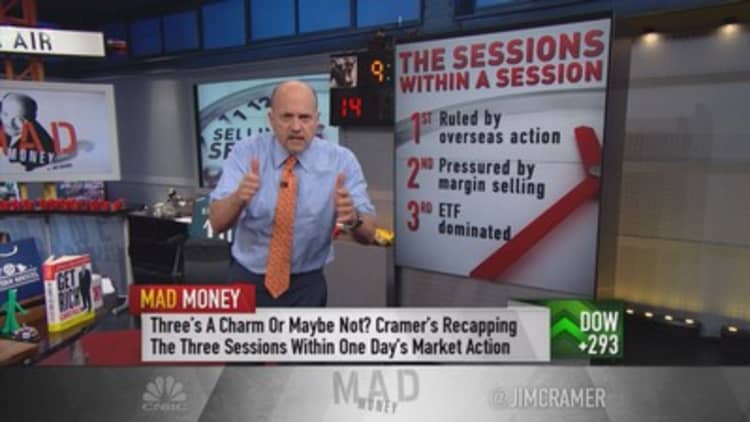

This market has now become so crazy, that Jim Cramer can now equally divide each day into three distinct trading sessions. At this point, every session isn't just one session. It's three!

"Every day feels like not one session, but three sessions and that's adding to the pervasive sense of confusion," the "Mad Money" host said.

The first session occurs at the opening bell, and is driven from the data and stock market action in China and Europe. The futures now completely control the morning session, and Cramer has seen the same pattern over and over again.

Bad news will come out of China, and then the Chinese stock market will tank, and then its stocks will be either halted or propped up by the Chinese government to try and assure investors that there is more order to the chaos.

And of course when the Chinese market is down, Europe will also trade down. The two continents are somewhat linked, because 25 percent of China's exports go to Europe. And while the U.S. and China don't do a lot of business, Cramer has seen that the U.S. market goes down harder than Europe because of investor's newfound negative bias.

The second session takes place at approximately 11:30 a.m. ET every day and is entirely dictated by sellers. Cramer called this the "margin session" because it is driven by speculative traders who have borrowed money from their brokerage firms on margin.

On a hideous trading day, the value of collateral held in these investor's accounts will drop significantly, prompting margin clerks to send out margin calls. If the investors do not wire in more money, then securities must be sold to raise the money.

That margin selling can last until 2 p.m. and flood the market if there are a lot of margin calls. And with an abundance of margin calls, the third session called the "ETF-dominated session" is created.

The final ETF session kicks in at approximately 2:45 p.m. ET each afternoon when exchange traded funds have to settle up. When someone buys an ETF that bets heavily against stocks, it settles up by knocking down the stocks. The same thing occurs with a bullish ETF, as they use leverage to magnify their influence.

"Typically you don't see them play such an outsized role, but this is not a typical market," Cramer said.

Generally corporate buybacks will cushion the blow to ETF selling, but buybacks are halted at 3:30 p.m. ET every day so the company cannot control the price of its stock at the close. However, right now the market is so thin that these ETFs are now determining the close.

Read more from Mad Money with Jim Cramer

Cramer Remix: These stocks are China-proof

Cramer: Buckle up! Oil could skyrocket

Cramer: Is this the 2011 collapse all over again?

As a result, traders now spend the afternoon trying to figure out how the ETFs will settle up so they can determine the direction that the market will close.

"Ugliness can breed further ugliness," Cramer said. (Tweet This)

So with three sessions of trading each day, what do these sessions have in common?

None of these sessions has anything to do with individual stocks or the underlying fundamentals of a company. For now, the old fashioned methods of trading have been thrown out the window. Instead, it has created a new world of futures, margin and ETF dominance.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com